Summary of Benefits and Coverage

Benefits Summaries

Certificates

Education

Covered Drug Lists

Brochures

Virtual Primary & Health Care

Benefit Summaries

Certificates

Education

Benefit Summaries

Certificates

Education

Health Savings Account

Flexible Spending Accounts

Commuter Benefits

Employee Assistance Program

Basic Life and AD&D

Supplemental Life and AD&D

Short-term Disability

Long-term Disability

Plan Highlights

Summary Plan Description

Accident Insurance

Critical Illness Insurance

Hospital Indemnity Insurance

Pet Insurance

BlueBikes Discount

MetLaw

Bright Horizons

Equity Compensation

Compliance Notices

Medicare Part D Notice

Other Documents

Electronic Labor Laws

You can access the up to date U.S. Federal & State Labor Law Posters for your state here.Ginkgo Bioworks

2024 Benefits Hub

Surprise Billing Notice →

The Benefits Hub is a one-stop shop for all of your year-round benefits needs. Get access to everything you need – plan documents, contact information, plan information, in-network provider search, and more – at the click of a button!

To get started, click a Plan Icon or just continue scrolling.

Ginkgo Bioworks Benefits Plans or Enrollment?

Email benefits@ginkgobioworks.com

or call our Benefits Advocates at

844-928-4042

Healthy Family Living Month

As we bid farewell to summer and prepare for the back-to-school season, it’s the perfect time for families to focus

on health and wellness together. From engaging in fun fitness activities to enjoying nutritious meals and practicing

mindfulness, these small changes can make a big impact.

Join us in exploring ways to build strong, healthy habits

that will benefit the whole family year-round.

Monthly Wellness Newsletters

Medical Plans

In-network costs shown. See Summary of Benefits and Coverage under the ‘Documents’ section for out-of-network details.

Ginkgo offers three medical plans through Blue Cross Blue Shield of Massachusetts.

Blue Care Elect

Preventive Care:

100% covered

Primary Care Office Visit:

You pay a $25 copay

Deductible:

$1,000 (I) / $2,500 (F)

Preferred Blue PPO Saver

Preventive Care:

100% covered

Primary Care Office Visit:

You pay 0% after deductible

Deductible:

$2,000 (I) / $4,000 (F)

Advantage Blue EPO

Preventive Care:

100% covered

Primary Care Office Visit:

You pay a $15 copay

Deductible:

$500 (I) / $1,500 (F)

Virtual Primary & Health Care

Choose between two options: Firefly Health and Carbon Health

Learn moreMedical Plan Details

Blue Care Elect

-

Deductible

$1,000 (I) / $2,500 (F)

-

Out-of-Pocket Maximum

$3,000 (I) / $6,000 (F)

$1,000 Rx (I) / $2,000 Rx (F) -

Bi-weekly Premium

Employee-Only: $43.80

Employee + Spouse: $165.29

Employee + Child(ren): $148.31

Family: $249.96

Preferred Blue PPO Saver

-

Deductible

$2,000 (I) / $4,000 (F)

-

Out-of-Pocket Maximum

$6,750 (I) / $13,500 (F)

-

Bi-weekly Premium

Employee-Only: $11.37

Employee + Spouse: $94.74

Employee + Child(ren): $85.01

Family: $143.27

Advantage Blue EPO

-

Deductible

$500 (I) / $1,500 (F)

-

Out-of-Pocket Maximum

$3,000 (I) / $6,000 (F)

-

Bi-weekly Premium

Employee-Only: $43.18

Employee + Spouse: $162.98

Employee + Child(ren): $146.23

Family: $246.38

Blue Care Elect

-

Preventive Care

100% covered

Preferred Blue PPO Saver

-

Preventive Care

100% covered

Advantage Blue EPO

-

Preventive Care

100% covered

Blue Care Elect

-

Primary Care

You pay a $25 copay

-

Specialist Visit

You pay a $40 copay

Preferred Blue PPO Saver

-

Primary Care

You pay 0% after deductible

-

Specialist Visit

You pay 0% after deductible

Advantage Blue EPO

-

Primary Care

You pay a $15 copay

-

Specialist Visit

You pay a $30 copay

Blue Care Elect

-

Urgent Care

You pay a $40 copay

-

Emergency Room

You pay a $150 copay

Preferred Blue PPO Saver

-

Urgent Care

You pay 0% after deductible

-

Emergency Room

You pay 0% after deductible

Advantage Blue EPO

-

Urgent Care

You pay a $30 copay after deductible

-

Emergency Room

You pay a $150 copay

Blue Care Elect

-

X-rays/Lab

You pay 0% after deductible

Preferred Blue PPO Saver

-

X-rays/Lab

You pay 0% after deductible

Advantage Blue EPO

-

X-rays/Lab

You pay a $15 copay after deductible

Blue Care Elect, Preferred Blue PPO Saver, and Advantage Blue EPO Plans.

-

Fitness Reimbursement

$150 reimbursement per calendar year for enrolled Bioworkers, when you participate in a qualified fitness program.

-

Weight Loss Reimbursement

$150 reimbursement per calendar year for enrolled Bioworkers, when you participate in a qualified weight-loss program.

-

Wellness Rewards Program

Enrolled Bioworkers can earn points when they complete certain health care and wellness activities. Points earned go toward wellness dollars that can be redeemed up to $400 per plan year, not to exceed $100 per plan quarter.

-

Learn to Live Mental Health Care

Enrolled Bioworkers, and their dependents, can access the ‘Learn to Live’ online mental healthcare resource through their MyBlue account. The program is available at no cost.

Prescription Drug

Plans offered through Blue Cross Blue Shield of Massachusetts.

View your covered prescription drugs here →

Dental Plans

In addition to protecting your smile, dental insurance helps pay for dental care and includes regular check ups, cleanings, and x-rays. Receiving regular dental care can protect you and your family from the high cost of dental disease and surgery.

Ginkgo offers two dental plan options through MetLife.

High Plan

Deductible:

$50 (I) / $150 (F)

Basic Services:

90% covered

Major Services:

60% covered

Orthodontic Services:

50% covered

Low Plan

Deductible:

$50 (I) / $150 (F)

Basic Services:

60% covered

Major Services:

0% covered

Orthodontic Services:

Not covered

Vision Plan

Ginkgo offers one Vision plan through MetLife (VSP Network) and provides vision benefits and discounts.

High Plan

Network Coverage:

$210

Exam Copay:

$10

Lenses:

12 months

Low Plan

Network Coverage:

$130

Exam Copay:

$20

Lenses:

12 months

Spending Accounts

Included Plans:

✓ Health Savings Account (HSA)

✓ Flexible Spending Accounts (FSA)

✓ Commuter Flexible Spending Account (CFSA)

Voluntary Benefits

Benefits that go above and beyond in covering every base for your benefits needs.

Included Benefits:

✓ Accident Insurance

✓ Critical Illness Insurance

✓ Hospital Indemnity Insurance

✓ Life and Accidental Death and Dismemberment

✓ Grief Counseling

✓ Pet Insurance

✓ BlueBikes Discount

✓ MetLaw

Employee Assistance Program

Access MetLife’s EAP and you’ll have a source to help support your overall wellness – medical, financial, legal, and mental health. MetLife’s EAP offers self-guided programs to support you through challenging issues such as anxiety or the loss of a loved one.

Grief Counseling:

Your MetLife employer-paid life insurance plan offers you, your dependents, and your beneficiaries access to face to face grief counseling sessions and related concierge services to help cope with a loss.

The 401(k) Plan

Traditional & RothBioworkers are eligible to participate in Ginkgo’s 401(k) Retirement Savings Plan, administered through Principal. The program offers both traditional & Roth contributions. New Bioworkers are auto-enrolled at 6% pre-tax.

Time Off

Bioworkers receive a myriad of Time Off benefits.

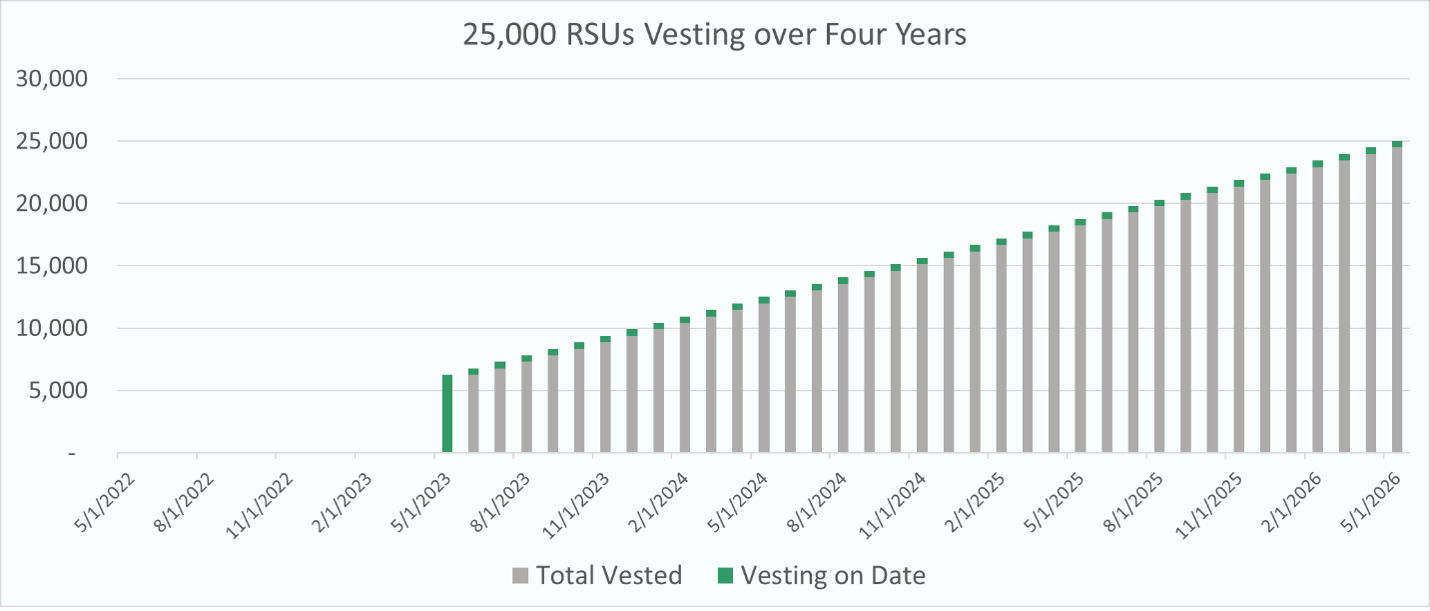

Equity Compensation

Equity awards are an important part of your total compensation package at Ginkgo. Having equity means being a partial owner of the company. Our equity program helps us compete for the most talented Bioworkers while reinforcing our ownership mindset.

At Ginkgo, equity awards are typically issued as restricted stock units (RSUs). RSUs offer the opportunity to own actual shares of Ginkgo stock at one or more future dates, subject to certain vesting requirements being met.

Compliance

Your hub for compliance information, forms, and contacts you may not have found elsewhere.

A Summary of Benefits and Coverage (SBC) has been designed to assist you with better understanding the coverage being offered to you, and to allow you to compare coverage options. The SBC is available on www.ginkgobioworksbenefits.com. A paper copy is also available, free of charge, by calling 877-422-5362.

Ginkgo Bioworks permits insurers to offer employees of Ginkgo Bioworks certain voluntary insurance programs. Whether you choose to enroll in any of these programs is completely optional and voluntary. Ginkgo Bioworks does not make a contribution towards the cost of these programs and employees pay the full cost of premiums on an after-tax basis. Ginkgo Bioworks does not sponsor, maintain, endorse, recommend, or promote these voluntary programs. Ginkgo Bioworks'S involvement regarding these voluntary insurance programs is strictly limited to allowing the insurer access to employees to publicize these programs and Ginkgo Bioworks may perform certain ministerial functions such as payroll deduction and forwarding employee premium payments to the insurer. Ginkgo Bioworks does not receive any consideration in the form of cash or otherwise in connection with the program, other than reasonable compensation, excluding any profit, for administrative services actually rendered in connection with payroll deductions. Accordingly, these voluntary insurance programs are not subject to ERISA and related regulations. All questions or claims regarding these programs should be directed to the insurer.

All benefit plans are governed by master policies, contracts, and plan documents. In the event of any inconsistency between the information contained herein and the applicable plan documents, the provisions of the plan documents shall prevail. Ginkgo Bioworks reserves the right to amend, suspend or terminate any benefit plan, in whole or in part, at any time. The authority to make such changes rests with the Plan Administrator.

© Piper Jordan. All Rights Reserved.

*The chart above is an example using 25,000 RSUs and is only intended for illustrative purposes.

*The chart above is an example using 25,000 RSUs and is only intended for illustrative purposes.